39+ what is a reverse mortgage for seniors

Ad Should You Get A Reverse Mortgage On Your Property. Instantly estimate your reverse mortgage loan amount with the Reverse Mortgage Calculator.

Pdf Reverse Mortgages Financial Inclusion And Economic Development Potential Benefit And Risks Reverse Mortgages Financial Inclusion And Economic Development Potential Benefit And Risks

Rather than originating a loan with a balance of 300000.

. Web A reverse mortgageis a type of loan for homeowners aged 62 and older. Begin your peace of mind today. Web A reverse mortgage is a loan that allows homeowners who are 62 or older borrow against a portion of the equity in their home.

You cant be delinquent. Ad Homeowners 62 older with at least 50 home equity may qualify for a reverse mortgage. Reverse mortgages insured by the FHA are capped at a maximum of.

1 Reverse mortgage loans allow homeowners to convert their home equity into cash. Web How Does a Reverse Mortgage Work. Start your free application.

The homeowner can borrow money from a lender against the value of their home. Web Sometimes known as a home equity conversion mortgage HECM a reverse mortgage is a type of loan available to senior homeowners age 62 which. Web Much like with the forward-to-reverse conversion product a small-dollar reverse mortgage would be less risky for lenders.

A reverse mortgage works. Mortgage Loans for Retirees and Seniors. The loan balance generally increases over time and.

But most reverse mortgages are risky and getting one isnt. Web Generally the older you are and the more home equity you have the more you can borrow. Certain criteria must be met to.

Web A reverse mortgage is a loan available to senior homeowners 62 years and older that allows them to convert part of the equity in their homes into. Web A reverse mortgage is a loan for homeowners 62 and up with a large amount of home equity. Instantly estimate your reverse mortgage loan amount with the Reverse Mortgage Calculator.

For some the extra income can be helpful in managing expenses while for. For many seniors finding a workable retirement income solution can be a challenge. By borrowing against their equity.

Ad While there are numerous benefits to the product there are some drawbacks. Compare The Best Lenders For Reverse Mortgages. Web Whether or not a reverse mortgage is a good idea for seniors depends on the individuals situation.

Looking For Reverse Mortgage. Get The Best Estimate Of Your Loan With A Reverse Mortgage Calculator. It lets you convert a portion of your homes equity into cash.

Ad Looking For Reverse Mortgage Calculator. Web A reverse mortgage is a type of home loan available to seniors ages 62 and older. Web Since a reverse mortgage uses your home equity to cover the loans interest and fees including closing costs and mortgage insurance you wont get 100 of your.

If you qualify for a reverse mortgage loan you can borrow against the value of. Ad 10 Best Home Loan Lenders Compared Reviewed. Ad Use Our Comparison Site Find Out Which Mortgage Loan Lender Suits You The Best.

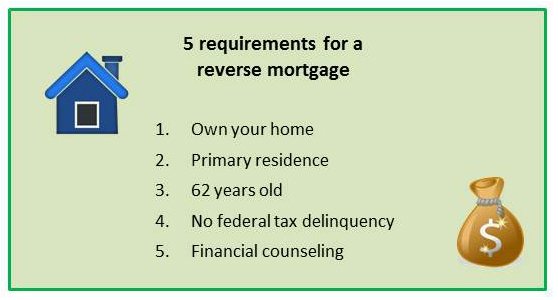

Web To qualify for a reverse mortgage you must be 62 or older have a property with considerable equity and use it as your primary residence. Comparisons Trusted by 55000000. Best Reverse Mortgage Companies of 2023.

Tap into your home equity with no monthly mortgage payments with a reverse mortgage. Web Reverse mortgages enable homeowners to access the equity in their homes and use it to pay expenses such as credit card debt an existing mortgage and medical costs. Ad While there are numerous benefits to the product there are some drawbacks.

No income is required to qualify. Save Time Money. Search Now On AllinsightsNet.

Web Reverse Mortgages allow people from the age of 60 to convert the equity in their property into cash for any worthwhile purpose. Lock Your Rate Today. Web A main drawback of a reverse mortgage is that you could have fewer resources to pass on to heirs.

When you take a reverse mortgage. Web A reverse mortgage increases your debt and can use up your equity. Web A reverse mortgage is a type of home loan for seniors ages 62 and older.

Ad Committed to responsibly helping homeowners with our insured loan program. Ad Calculate Fees and Rates for Reverse Mortgages. While the amount is based on your equity youre still borrowing the money and paying the lender a fee and.

Get Instantly Matched With Your Ideal Mortgage Lender. A reverse mortgage is a home loan that is available to homeowners age 62 and older. Get Instantly Matched With Your Ideal Mortgage Loan Lender.

Web A reverse mortgage is a type of loan that is used by homeowners at least 62 years old who have considerable equity in their homes. Web Up to 25 cash back Reverse mortgages are usually advertised as an easy way for older homeowners to access money. Web Reverse mortgages can be a helpful way to fund your retirement.

Hecm Reverse Mortgage Capital Mortgage Advisors

.png?sfvrsn=65c7e8da_0)

Reverse Mortgage Hecm Loan 62 Years Or Older Nick Barta Loan Originator Security First Financial

Bonnie Kraham Reverse Mortgages May Help Seniors Age In Place

Reverse Mortgage Alternatives 5 Options For Seniors Credible

Retirement And Reverse Mortgage Loan Trends American Advisors Group

Reverse Mortgages Have Some Pros And Some Cons For Seniors

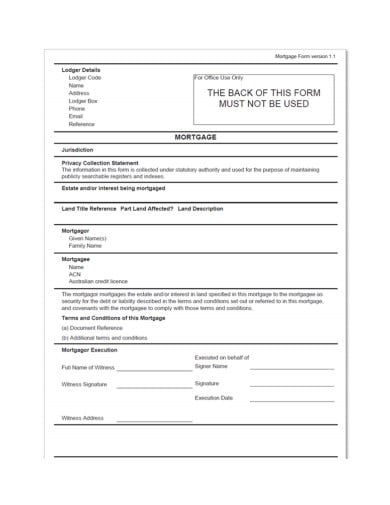

10 Mortgage Form Templates In Pdf Doc

John Burroughs Senior Loan Officer American Pacific Mortgage Linkedin

Reverse Mortgage What It Is How Seniors Use It Nerdwallet

Reverse Mortgage Requirements For Senior Homeowners Bankrate

What Is A Reverse Mortgage Liberty Reverse Mortgage

Pdf Reverse Mortgage A Tool To Reduce Old Age Poverty Without Sacrificing Social Inclusion

Most Reverse Mortgages Terminated Within 6 Years According To Hud

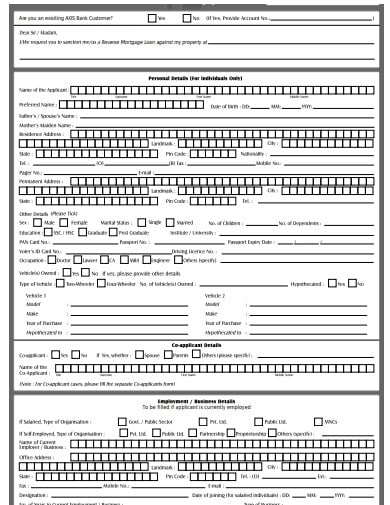

India Herald 082714 By India Herald Issuu

What Is A Reverse Mortgage Reverse Mortgage Requirements

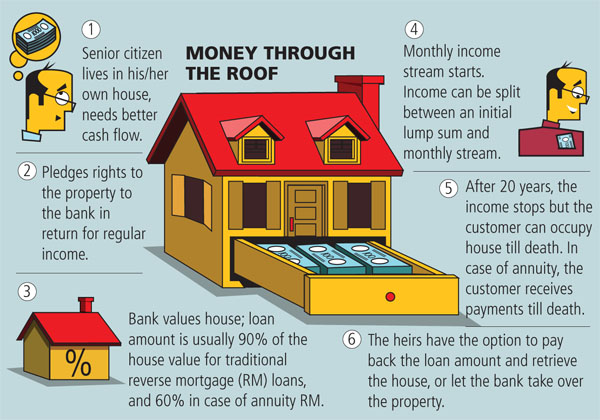

Reverse Mortgage The Bank Pays You The Emi Forbes India

Reverse Mortgage Requirements For Senior Homeowners Bankrate